Contents

2. Differing needs with respect to means of payment require different programmable euro solutions

3. Private-sector programmable euro solutions

3.1. Opportunities and risks of private-sector solutions

3.2. Optimisation of the existing payment system for the use of DLT and smart contracts

3.3. A programmable euro of the banking sector (bank money token)

3.4. A programmable euro outside the banking sector

4. Central bank digital currency (CBDC)

4.1. CBDC in the view of the private banks

Summary

- The programmable euro is an important innovation to secure Europe’s long-term competitiveness in the global economy. This is true for three reasons:

- Consumers will have a secure and efficient means of payment for the digital economy of the future.

- Businesses will be given a tool enabling them to promote the digital transformation – especially in industry – and ensure their competitiveness. The programmable euro is a prerequisite, among others, for Internet of Things (IoT) applications and the full automation of value-added processes. It offers the opportunity to hugely increase efficiency.

- Central banks can use digital central bank money to safeguard their monetary sovereignty and Europe’s financial stability.

- Europe needs to act swiftly and decisively since Asian and US initiatives such as the digital Renminbi or Libra threaten to pre-empt European projects.

- The provision of a modern, efficient and secure payment system is one of the core tasks of the banking industry. The banking industry has recognised the need for a programmable euro and is ready to take action.

- But not only banks, but also FinTech and BigTech companies are planning to introduce a stablecoin denominated in euros. The outcome of this competition is open. In addition to private-sector solutions, it would also be possible to provide central bank digital currency (CBDC) in the form of a programmable euro issued by the ECB.

- A programmable euro needs to take account of the different requirements that a payment system in an advanced economy has to meet. These requirements are defined by the differing needs of individual user groups.

- For the vast majority of payment transactions, private-sector solutions – especially those provided by the banking industry – should be able to satisfy these needs of the users. From today’s perspective, CBDC issued to users by the central bank directly will only be really necessary in a few cases.

- The introduction of a private-sector solution supported by banks could be implemented in two stages. In the short term, by adapting the existing instant payment regime to enable an interface with the DLT systems used in production processes. In the medium term, by establishing the banks’ own DLT-based infrastructure for the introduction of a programmable euro.

- High hurdles will need to be overcome to complete the second stage. The processing of payments in Germany and Europe is one of the most basic fields of activity for banks and payment service providers. Private-sector solutions should continue to play a dominant role in payment systems in the future.

- A European currency area that can be competitive and sovereign in the long term also requires CBDC in the form of a programmable euro issued by the ECB. The private banks believe the following four points should be taken into account.

- The existing monetary order should be changed as little as possible. Therefore, digital central bank money should be made available in the same way as cash, i.e. by the central bank lending to commercial banks.

- Digital central bank money may cause banks’ balance sheets to contract and change their structure. How these changes will influence banks’ lending capacity is an open question at present. CBDC should not be allowed to impair the flexibility of lending over the course of the business cycle.

- The effects on banks’ refinancing costs and earnings are impossible to predict as things stand. In any case, the responsiveness of banks must be guaranteed.

- CBDC should not be used as a monetary policy instrument. The loss of reputation of the central bank triggered by a strongly negative monetary policy interest rate could easily outweigh the desired expansionary impulse.

- Close cooperation across the entire industry is a prerequisite for the successful private-sector provision of a programmable euro by the banking system. This represents a challenge not only because of the competition between banks but also to a large extent because of competition policy, which sometimes significantly underestimates the role of digitalisation when defining the relevant market. The market power of a US BigTech is too great to be challenged by a single supplier.

- If the programmable euro is to become a successful reality, the central and rapid involvement of policymakers is required – not least in view of international developments. The introduction of a programmable euro cannot be the task of the banking industry or the ECB alone. We therefore call on policymakers to provide coordinating support for the creation of a European standard for a private-sector programmable euro. It will be up to the European Commission and the German government to begin formulating a process as soon as possible aimed at introducing a programmable euro without delay.

- In the coming months,

- the need for a programmable euro should be identified on a cross-industry basis and a large-scale programme should be launched to sensitise businesses to the issue,

- a European strategy for a programmable euro should be drawn up and a roadmap should be defined with the involvement of all those affected.

1. Introduction

Though the announcement by the Libra Association in June 2019 that it would issue a private cryptocurrency with a global reach in the foreseeable future did not trigger the discussion about the future shape of payments, it did provide it with an important impetus. The leaders of the consortium said at the time that their primary purpose was to facilitate access by poor people, in particular, to payment services and to use their programmable money to drastically reduce the cost above all of cross-border transactions. Nothing about this official goal has changed in the new white paper, which was published on 16 April 2020 in the wake of widespread criticism of the original plan. With its “new” Libra, the Libra Association is now distancing itself from the end customer and positioning itself as an infrastructure operator and currency issuer of a programmable euro, dollar, pound sterling and other currencies. This would move it in the direction of becoming a global central bank.

Numerous parallel initiatives surrounding the issue of “digital currency” can be observed around the world. A few weeks ago, the Chinese central bank launched a pilot project for a digital renminbi in several Chinese metropolis. Simultaneously, countries such as Sweden, Great Britain, Canada and South Korea are working intensively on the introduction of a central bank digital currency (CBDC). And German Finance Minister Olaf Scholz is backing “innovative European responses” to projects such as Libra. The innovative aspects of all these initiatives essentially focus on two elements: first, stablecoins[1] are to be created and used as new additional private-sector forms of money. Second, money is to be given a previously unknown quality: it is to become programmable.

Programmable money combines digital means of payment with smart contracts. The latter allow the money to be integrated into digitalised value-added processes, enabling money to be clearly allocated to individual process steps, where payment can be fully automated. Put simply, this means that a set amount of money can only be paid out once the conditions specified in the smart contract have been fulfilled. The smart contract therefore places constraints on the usability of money. If such a form of payment is used, a business process is automatically brought to a conclusion without the need to check the legitimacy of the payment again. From a technological point of view, programmable money in a mature form is based on stablecoins and distributed ledger technology (DLT). In a simpler form, programmable money could also be account-based, though its advantages could not then be fully exploited.

The discussion following the publication of the first Libra white paper revealed that there are a number of issues surrounding the nature of this new form of money, the future demand and the question of the issuer. To clarify the issues involved, a distinction needs to be made between the following three levels.

- At the level of the various “economic entities”, the question is what needs they have and what contribution digital money can make to satisfy these needs.

- The macroeconomic level and thus the question of precisely what form of money a stablecoin actually represents is probably the central aspect. Closely related to this are questions about the effects on the stability of the system, including the stability of the banking sector, and on the economic policy sovereignty of states and the scope for monetary policy control.

- At the technological level, answers must be provided to questions concerning issues such as volumes, scalability and interoperability.

Discussions about the future development of payment systems must also ensure that

- the resilience of the payments infrastructure is not compromised,

- competition and the further development of digital innovations are made possible,

- private money does not pose a risk to financial stability or client assets,

- solutions are found to the question of how to deal with a further reduction in the amount of cash in circulation,

- and that improvements are made to the ability to make payments across borders.

- Another essential point: ensuring that existing regulatory requirements continue to be met and safeguarding the role of commercial banks in money creation.

The Association of German Banks set out its views on the Libra plans in two position papers issued in 2019: “Facebook’s cryptocurrency Libra – questions and answers” and “Beyond Libra: why the economy needs a digital euro”. This paper intends to make a further contribution to the debate.

2. Differing needs with respect to means of payment require different programmable euro solutions

A prerequisite for the successful implementation of a future payments strategy is an accurate forecast of the future needs of different user groups. A forecast of this kind nevertheless risks being misleading. A comparison of the identified needs with the current payment system could, after all, easily give the impression that the existing swift, reliable and secure payment system in Europe already meets all the needs of various user groups in the best possible way.

It would nevertheless be a mistake to conclude that there may be no need for innovation in payment systems. It is virtually impossible, in the initial phase in which we find ourselves, to predict the development of a new technology and its impact on households, businesses, banks and the stability of the financial system. Nevertheless, the entire experience of industrial history, and especially the technological innovations of the last 30 years, demonstrate that a new technology invariably generates new – and initially unforeseeable – needs and potential uses. Take the smartphone, for instance.

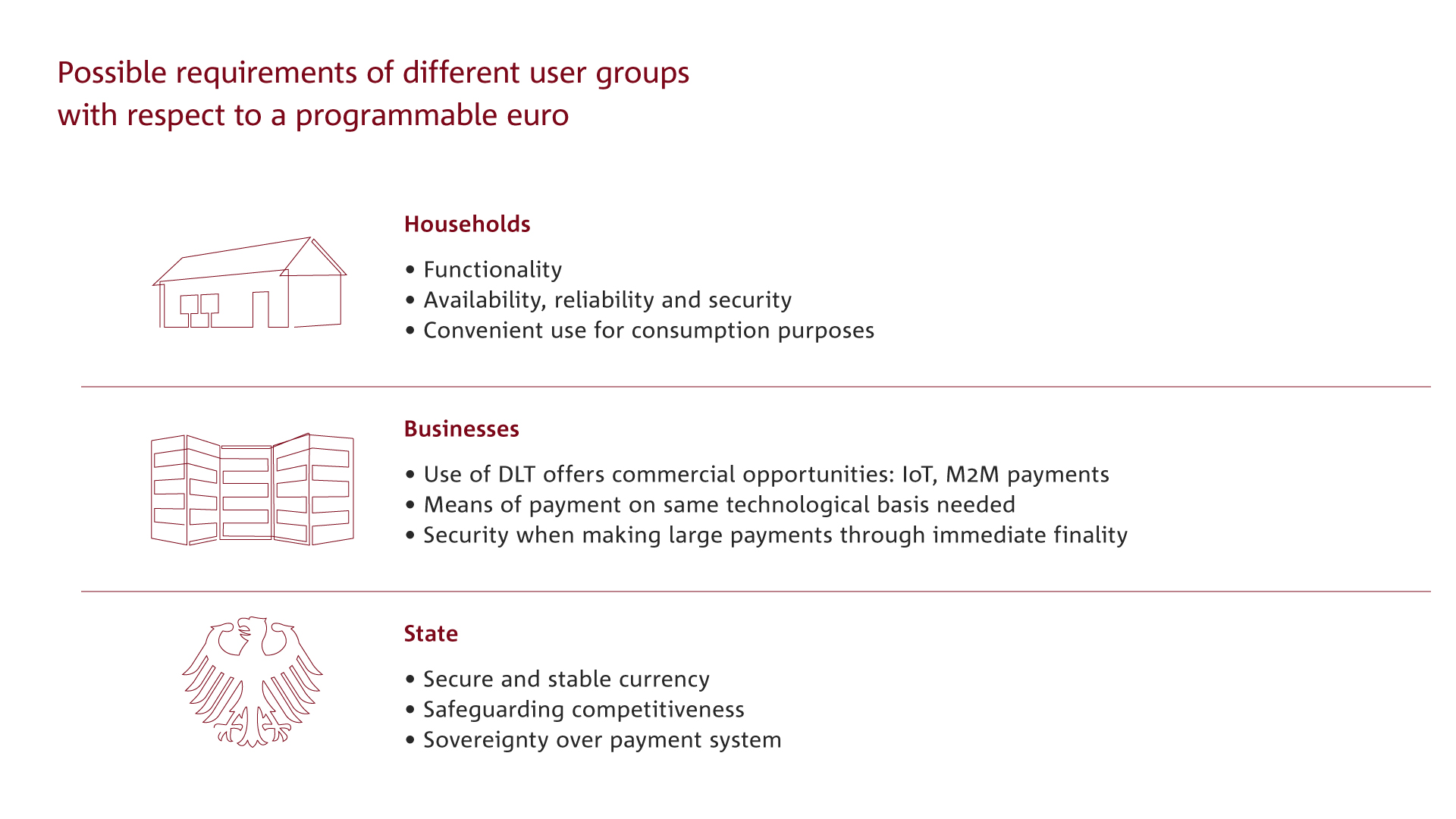

In the complex economies of industrialised countries, moreover, there are no uniform expectations of what a payment system is supposed to be capable of. The needs of different user groups are simply not identical.

- Households are primarily interested in the functionality of money. They do not, as a rule, distinguish between the issuers of different forms of money, i.e. between central bank and bank money. Households are interested above all in the availability, usability, reliability and security of the means of payment; there is no special focus on central bank money. What is important is that money can be used conveniently to consume products and services. They are probably unaware that cash is actually the only legally accepted means of payment.

Businesses differentiate a bit more. For them, it is possible to identify a need for crypto-based forms of money on two levels.

- First, there is the increasing demand for programmable money. The background: DLT will make an increasing contribution to solving technical and economic problems in the coming years. There are already a large number of pilot projects in areas such as securities or logistics. In future, however, increasing emphasis will be placed on applications in the area of “digital transformation” in the form of the Internet of Things (IoT), for example. If DLT is to effectively develop its potential here, a means of payment on the same technological basis will be needed – and that means the programmable euro. At present, however, businesses are focused primarily on whether DLT-based payments are just as reliable and secure as payments today. From their point of view, it is doubtless of secondary importance (and, moreover, it currently remains a totally open question) who will make this new type of money available – payment service providers, banks or central banks.

- In contrast to households, businesses normally have large bank deposits to manage, so CBDC is likely to represent an interesting alternative since deposits in CBDC would tend to offer them greater security than bank deposits.

- The interest of the state is primarily to guarantee households and businesses a secure and stable currency and, based on this, an efficient payment system. It will only embrace technological innovations if they are necessary to safeguard the security of the currency, the stability of the monetary order and competitiveness.

Competitive disadvantages for European companies would be particularly likely if a programmable euro in the form of CBDC were introduced later than digital forms of other reserve currencies. Possible efficiency gains by other economies as a result of the earlier use of programmable money in local value-added processes could create macroeconomic competitive advantages that European businesses could not compensate for in both the short to medium term. Without a programmable euro issued by the ECB, Europe could fall behind its international competitors. In addition, there could be increasing dependence on non-European money issuers if European businesses had to make use of non-European payment solutions to maintain their competitiveness.

Central bank money: is cash issued by, or demand deposits held at, a central bank. While cash is the generally available means of payment, only banks and selected financial institutions have access to the Bundesbank in Germany, for example. Central bank money is a liability of the central bank covered by assets such as gold or government bonds. Central bank money has no default risk – it is not subject to liquidity or creditor risk.

Deposits in a bank account (bank money): represent a claim on the bank in question. They are tied to a promise to exchange this claim at any time, without limit and at a ratio of 1:1 for central bank money – i.e. cash. A bank transfer is therefore the assignment of a claim to cash. In order for this assignment to be accepted by both the payee bank and the payee (interoperability), the use by banks of central bank money (deposits at the central bank) is necessary.

Central bank money versus bank money: In the course of day-to-day business, the right to central bank money plays only a minor role. Liabilities can frequently only be settled nowadays by bank transfer, no longer with cash. From the point of view of banks’ customers, cash and bank deposits are almost perfect substitutes.

The differing needs of different economic entities thus produce a somewhat heterogeneous picture. Although the demand for programmable money is likely to increase, CBDC will initially – as things stand today – rarely be really necessary from a user’s perspective. If it is only the functionality of a stablecoin that is desired, private-sector solutions are likely to be able to satisfy these needs. State institutions will nevertheless have to consider the possible impact on competitiveness of the introduction of a digital renminbi or Libra 2.0, for example.

3. Private-sector programmable euro solutions

Deutsche Bundesbank has repeatedly argued that the banking industry itself should offer payment solutions to satisfy new customer requirements. DLT has an especially important role to play in this context. Banks are thus called on to create a programmable euro.

3.1. Opportunities and risks of private-sector solutions

Processing payment transactions in Germany and Europe is indeed the most basic field of activity for banks and payment service providers. There is therefore no reason not to assume that private-sector solutions will also dominate the processing of payments in the future.

- This is because the development time for a programmable euro on a private-sector basis will probably be shorter.

- First, the necessary technological resources are more likely to be found in the hands of private companies.

- Second, shorter decision-making processes within these companies can accelerate the time to market for a privately designed programmable euro.

- And, third, competition in the market generally puts companies under greater pressure to innovate than public-sector institutions.

- In addition, shorter decision-making processes allow a high degree of flexibility, firstly to respond to technological or monetary difficulties and secondly to react to changing customer needs. From a competitive point of view, a privately designed programmable euro will probably be better tailored to customer needs than one issued by a central bank.

To enable broad acceptance of the means of payment, however, pressure to innovate and competition should not be allowed to stand in the way of the cooperation in the banking sector needed for this purpose. The natural tension between competition and cooperation must therefore once again be overcome in the interests of establishing a uniform, privately supplied digital euro in the banking sector.

But there are also risks associated with a solution developed exclusively by the private sector. Though it is true that there is probably greater technological expertise in the private sector, confidence in a currency depends first and foremost on the state monetary order and not least on the independence of the central bank. While independent central banks enjoy great confidence among broad sections of the population, a programmable euro developed by the private sector is likely to give rise, at least initially, to a number of proprietary and thus fragmented solutions. Although the market will consolidate over time, there is no guarantee that a generally accepted programmable euro will emerge from the competitive process. If there are also differences in the quality of the various private sector solutions, the overall reputation of the currency could be damaged.

This because competition between different proprietary models of a programmable euro would only reflect incomplete interoperability between the various forms of money. But without the attribute of a generally accepted medium of exchange, an essential advantage of money disappears. A programmable euro issued along these lines would then be difficult to use as a unit of account, which would impose high transaction costs on economic exchange and make it less attractive.

This highlights the fact that private-sector solutions also carry a high investment risk that only very financially strong firms are willing to bear or that has to be backed by venture capital. A consortium or cooperation of several market participants could solve this dilemma.

With all this in mind, it is therefore clear that banks will have to overcome numerous hurdles before they are in a position to make available a programmable euro.

-

Ensuring interoperability

Although each individual bank will be able to offer its customers its own stablecoin, this would not initially guarantee acceptance outside the issuing bank. Stablecoins are digital values in the form of tokens. They are not held in accounts as in conventional banking and once issued, as with cash, no banks are needed to act as intermediaries in the transaction. A peer-to-peer transaction outside the banking system would therefore be possible. For users, the question nevertheless arises as to what would guarantee the “value proposition” of the token.

-

Disintermediation

The concept of the stablecoin is in sharp contrast to that of account-based banking. A significant amount of stablecoins in circulation enabling peer-to-peer payment transactions in the same way as cash will inevitably lead to disintermediation of banks.

-

Pressure to innovate and simultaneous investment in existing business models

Technological change is part of day-to-day business for banks, but the speed at which digital transformation is advancing and changing businesses and industries poses extraordinary challenges to the management of established firms. They must make sure that their existing resources and skills are used efficiently while, in parallel, developing new resources and skills in the field of technological innovation. DLT confronts banks with this very same challenge.

This is because the needs of customers differ widely and a large proportion of payments will continue to be able to be processed in the familiar account-based banking world. Given the undeniable trend towards instant payment, however, banks will not be able to avoid making resources available for this as well. More than that, they will need to invest time and effort in developing instant payment systems into something resembling programmable money so that they can remain competitive in the short and medium term and compete with providers such as Libra. In the long term, more radical transformation of the payments infrastructure will be essential.

3.2. Optimisation of the existing payment system for the use of DLT and smart contracts

The existing European payment system is efficient and – through instant payment – can execute payments in real time. To satisfy industry’s requirements regarding the use of smart contracts, however, adjustments need to be made to the standardised “SEPA real-time transfer” system.

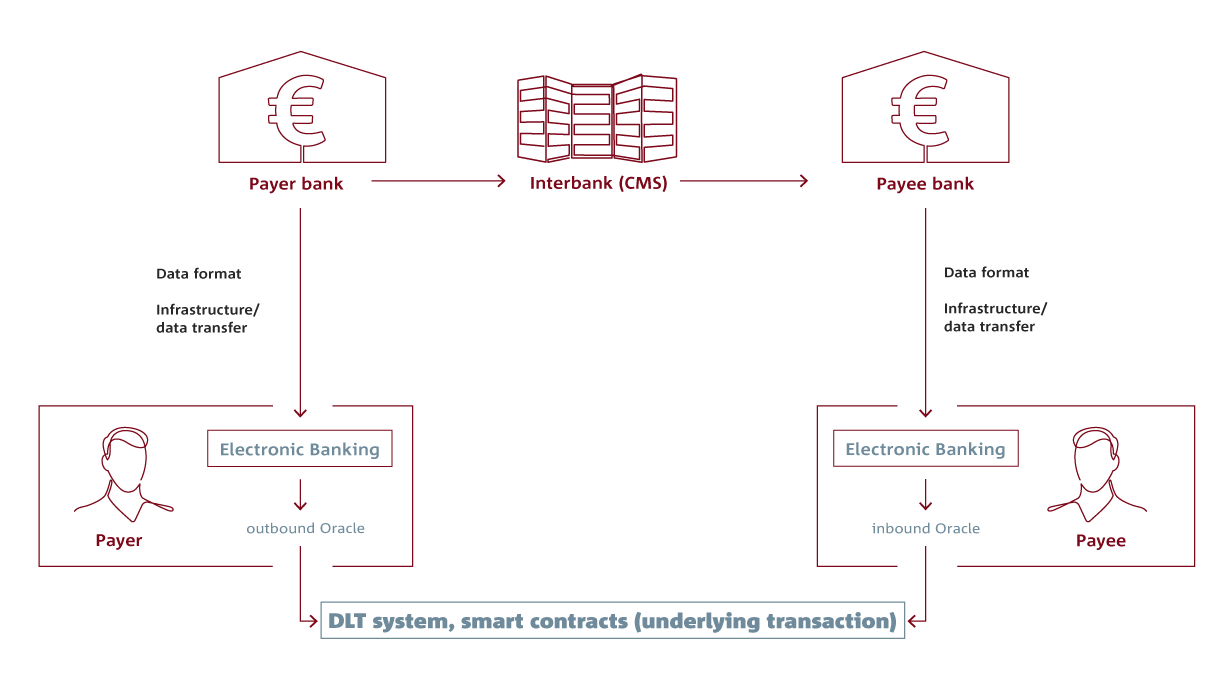

An optimised system can be modelled as follows: at the initiation of the transaction, claims measurable in euros are established between the payer and payee as a result of a smart contract activated in a jointly used DLT system (underlying transaction). The underlying transaction on the DLT system must be connected with the existing instant payment system by an interface.

This important interface function is performed by the data suppliers (oracles) of the DLT system, which either provide the DLT design with external information or bring data from the DLT system to the outside. The DLT can be operated independently of the banks involved in the settlement of the claim and is also independent of the underlying payment system. The following paragraph considers the elements coloured red (see figure) – the parts of a conventional payment transaction at the customer-bank interface.

On the debtor (payer) side, the DLT system sends information via an outbound oracle to an electronic banking system, which can generate a corresponding instruction to the payer’s bank to debit their payment account (steps 1 and 2). The payment is cleared in the interbank space and the creditor (payee) receives an amount credited to their payment account of (step 3). An electronic banking system connected to the bank of the payee receives information about the credit (step 4) and sends it to the DLT system via an inbound oracle (step 5). This enables the DLT system to clearly match the incoming payment to the open claim and confirm it as settled.

As conceivable as the design of such a system may be, a number of further questions and considerations nevertheless arise. Take, first of all, the data formats used. Are the data elements defined in the SEPA system sufficient to reliably transmit the information required by the oracles? Is standardisation needed to ensure that the information required for the oracles can be matched to the SEPA data formats in a uniform manner?

Secondly, there is the question of infrastructure standards in the customer-bank area. The currently accepted market standard, EBICS (Electronic Banking Internet Communication Standard), is only partially suitable for a high number of time-critical individual transactions. The German Banking Industry Committee (GBIC) is, however, already working on a standard for optimising the integration of EBICS into time-critical processes.

Thirdly, the existing book-entry and clearing and settlement systems for SEPA real-time transfers have technical and economic limits. It is true that, in terms of capacity and load processing, the systems are designed to handle a large number of transactions (2018: 6.4 billion SEPA credit transfers in Germany). But capacity limits could be reached if the frequency of claim settlement set by DLT systems caused an extreme increase of this base (e.g. micropayments in IoT applications). Furthermore, unit costs in the conventional payment system, which are the major factor determining the fee structures of payment service providers, are independent of the actual transaction amount. This means that a continuous flow of orders for payments of very small amounts by SEPA real-time credit transfer is neither technically nor economically feasible.

And last but not least, the existing legislation governing payments could only partially accommodate fully automated payments. Automatic triggering of a payment instruction is not compatible with the basic assumption of European payments law that firms should ensure explicit authorisation as well as authentication with two security factors (strong customer authentication).

If the challenges outlined above can be successfully addressed, it may be advantageous to integrate DLT into the SEPA payment system.

3.3. A programmable euro of the banking sector (bank money token)

Banks could create a private-sector solution for a programmable euro which does not need to be backed one hundred per cent by deposits. First of all, however, the existing scriptural money network will need to be transferred to DLT. This is already technically feasible, but successful implementation requires both agreement on a DLT technology accepted by all parties involved and consensus on the joint development of a standard. Otherwise, interoperability can only be achieved by means of complex technological solutions, which would severely restrict acceptance.

Such a bank money stablecoin would not immediately be used for all purposes or for all customers. It could initially be used in securities settlement or in the area of machine-to-machine payment (IoT), where there is likely to be immediate demand, and gradually spread from there. But this kind of stablecoin would also have the potential to compete with solutions such as Libra, provided that market participants overcame obstacles to interoperability.

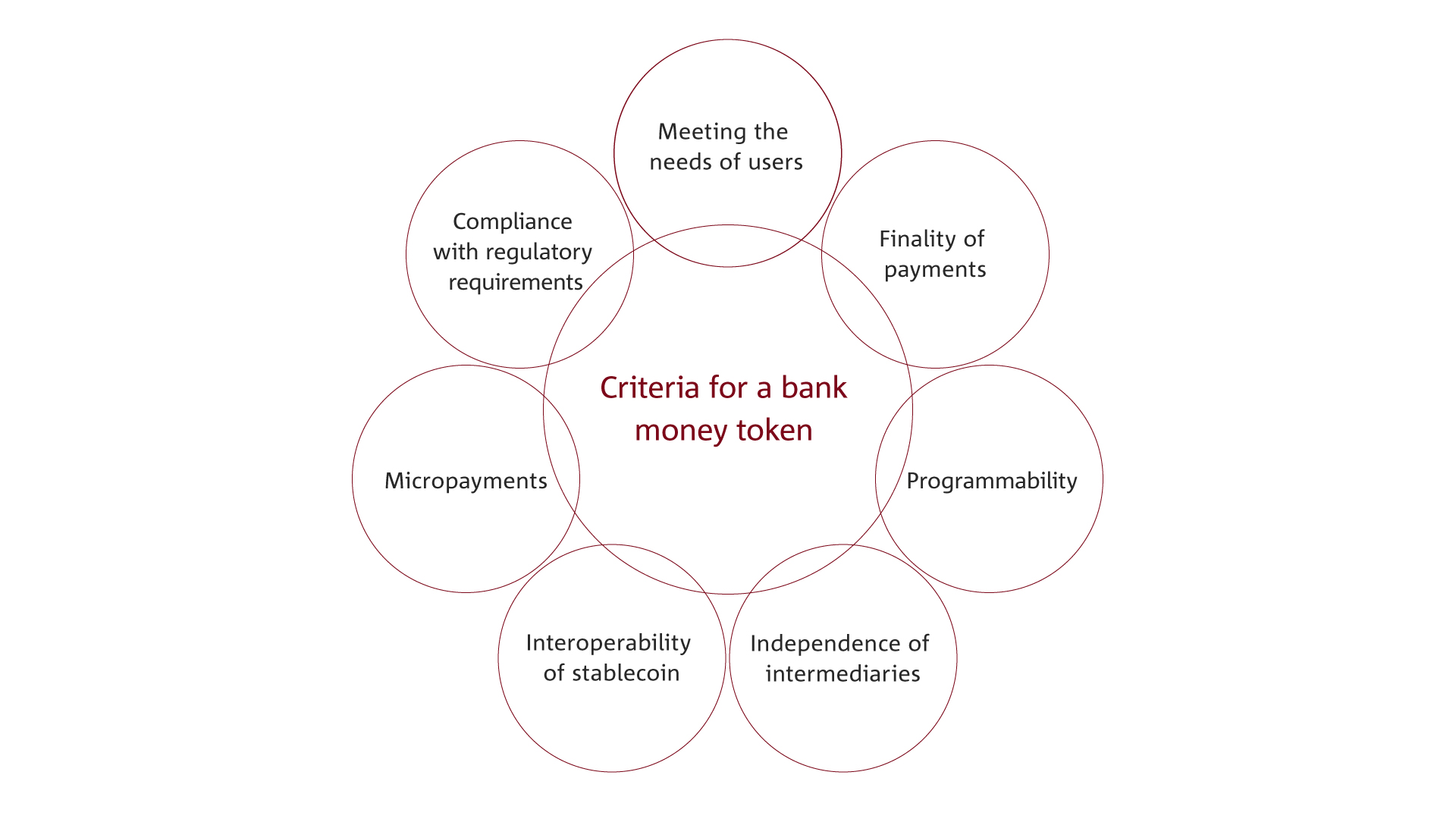

A digital euro issued by commercial banks needs to meet seven key criteria that cannot, or cannot fully, be met by a solution based on accounts and instant payment.

-

A digital euro must be able to fully meet the needs of users and their demand for digital solutions.

Different user groups have very different needs, some of which go far beyond the payment function. For all target groups, the digital euro must be user-friendly, inclusive, flexible, digital from end to end, future-proof and available throughout Europe. An open standard is needed that is accessible to all market participants. - When triggered, payment must be final virtually immediately.

The finality of payments is important so that processes can be carried out virtually without interruption on automatic confirmation. This is a major challenge as things stand, as is demonstrated by the use of DLT solutions in industry.

- Programmability must be ensured.

The automatic processing of transactions without human intervention is one of the core benefits of a programmable euro. This enables resource-saving handling of processes almost in real time. It can be achieved by integrating a stablecoin into smart contracts (e.g. for automated payment in a delivery-versus-payment context).

- The independence of intermediaries and the availability of the payment function at all times must be guaranteed.

The model of the Swedish central bank and its e-krona project suggests that a further reduction in the use of cash would increase the dependence on intermediaries. Possible risks associated with the default of intermediaries should be mitigated by developing platform solutions using DLT. Today’s intermediaries would then be platform operators in an ecosystem with a decentralised structure. Such a system must ensure the availability of the payment function at all times.

Stablecoins must be interoperable. -

Stablecoins must be interoperable.

Banks will probably not issue one programmable euro based on one single standard. Instead, we will probably see several different stablecoins and interoperability must be ensured. It is particularly important that stablecoins can be used to offset different types of transaction – such as securities transactions vs. documentary transactions. This interoperability could be achieved with a private-sector solution or, the preferable option, by involving central banks, which already carry out the settlement of fractions for SEPA and could also perform this function for a programmable euro issued by commercial banks. - It must be possible to process micropayments in an economically viable way.

A feature of the IoT, in particular, will be payments of extremely small amounts. These cannot be processed in an economically viable way using today’s instant payment system. The technological design of a stablecoin issued by banks and its underlying processing systems must therefore be able to deal with micropayments in a way that makes economic sense.

- A digital euro must be compatible with regulatory requirements.

The solution must be secure and resilient in order to minimise the risk to all parties concerned. This will involve strict compliance with regulatory requirements as well as the use of state-of-the-art security technologies and high data protection standards.

The private banks want the programmable euro. But the technological challenges, particularly ensuring interoperability, will not be easy to overcome.

Collaboration between individual institutions in the financial services sector is characterised by a tension between competition and cooperation. The European market is highly fragmented and diverse. As a result, joint initiatives are often protracted affairs and therefore slow and inflexible.

This stands in the way of a programmable euro that can address the demands of digital transformation and compete with US and Asian solutions. Policymakers and central banks are thus called on to provide significant support for the implementation process by enabling all parties involved – above all across industries – to exchange information on specific needs and set an implementation agenda.

3.4. A programmable euro outside the banking sector

Not only banks, but also FinTechs and BigTechs are considering the introduction of a euro-denominated stablecoin. All projects want to exploit the advantages of DLT, such as speed and decentralisation, but each is taking its own individual approach. As a result, none of the projects can themselves fulfil the requirements of an interoperable means of payment – with the exception of Libra due to the sheer market power of the consortium behind it.

In its first white paper, the Libra Association focused primarily on the idea of giving a financial tool to people without a bank account and making peer-to-peer transfers easier. There was presumably also an intention to enable millions of sellers to operate directly on Facebook without the involvement of banks and to facilitate P2P payments with the help of WhatsApp, Instagram or other existing applications. In its new paper issued in April 2020, the Libra Association places the emphasis more on the role of an infrastructure operator and, above all, does everything it can to allay the concerns of regulators. It now presents itself as an offeror of various stablecoins denominated in existing fiat currencies. These stablecoins can be exchanged with the help of smart contracts for Libra coin, which – as in the first white paper – intends to establish itself as a multi-currency global means of payment. Libra is thus positioning itself in the correspondent banking segment but nevertheless wants to act as an infrastructure operator for DLT-based payment solutions and thus as the provider of a programmable euro. All in all, this makes Libra a very serious challenge for banks.

Apart from Libra, several other non-banking providers are campaigning for “self-sovereignty” and “openness” in banking. While Libra’s objective initially seemed geared to the B2C sector and is now focusing more on B2B, other projects have had their eye on the B2B sector from the outset. All have the goal of reducing settlement time to a minimum and curtailing the settlement process in order to save costs. Reducing settlement time and eliminating intermediaries will make cross-border payments easier and less expensive than they are today[2]. High expectations are also placed in the idea of bringing currently fragmented business solutions for processes such as settlement, clearing or messaging to one¬ DLT platform. A newly created interoperability of this kind would enable broad automation using smart contracts.

4. Central bank digital currency (CBDC)

From the banks’ point of view, the introduction of a CBDC would represent serious, but ultimately unavoidable, interference in the existing monetary order. Precisely how serious depends on a number of decisions concerning the technical design of the CBDC and on how attractive CBDC would be to users. The primary technical question is whether CBDC should be created in a traditional account-based form or in the form of a digital token. The next step would be for the central bank to decide whether or not to use DLT. Further decisions would then have to be made on whether or not CBDC should be interest-bearing and programmable.

Each of these decisions will lead to different forms of CBDC with different characteristics. As far as the impact on the monetary system is concerned, however, two of them will be key. First, it must be decided whether CBDC should only be available to banks and other financial institutions or whether CBDC should be a new form of money for all citizens. If the vote is in favour of a “CBDC for all”, a second decision will be needed on whether the central bank should distribute and administer the new form of money itself or whether this should be done through banks and financial service providers.

This is not the place to discuss all possible variations in detail. Many publications have already done so. The quintessence of these discussions is above all that there will be no single form of CBDC – not just because different decision paths through the technological options will lead to different forms of CBDC, but also because different central banks pursue different objectives. As box 4.1 demonstrates, there is a wide range of reasons and motives for CBDC. CBDC in the Bahamas, for example, where financial inclusion of the population is the primary objective, is understandably different to CBDC in Sweden, where the e-krona is intended to give citizens access to central bank money without cash.

Cost of cash.CBDC could reduce the cost of making available a legal tender.

Financial inclusion. CBDC would be a secure and liquid legal tender that does not even require individuals to have a bank account. This aspect would only be of interest to countries where the penetration of banking services is low, however.

Ensuring the stability of the payment system. CBDC would be a means of improving the resilience of the payment system in the face of increasing concentration in the hands of a few very large companies.

CBDC as a potential competitor to privately issued digital money. A domestic digital currency, i.e. a legal tender, can help to prevent the introduction of privately issued money, which may be difficult to regulate.

Support for the ongoing digital transformation. DLT-based CBDC would enable the settlement of DLT-based assets and machine-to-machine payment in the IoT and would facilitate automated payments using smart contracts.

CBDC as a monetary policy instrument. CBDC could improve the transmission of monetary policy. An interest-bearing CBDC could enhance the economy’s response to changes in the central bank interest rate. A negative interest rate could be deployed in times of prolonged crisis (breaching the “zero lower bound”).

CBDC as a fiscal policy instrument. The use of CBDC could deliver efficiency benefits in public administration. In the long term, the state could use DLT to handle social security payments or emergency measures efficiently, quickly and in a targeted manner. Indirectly, via public aid, this would also make CBDC more attractive to households.

We describe below how the private banks believe CBDC should fit into the existing monetary system. In doing so, we will leave the purely descriptive level and adopt a position. This is guided by the following maxim:

The smooth functioning of the existing stable monetary order, which grants banks alone privileged access to central bank money and ensures flexible and efficient financing of the economy and reliable identity verification by enabling the creation of money in the banking sector, should not be jeopardised by CBDC.

If this maxim is applied to the analysis set out in this paper so far, there is only one alternative when it comes to CBDC in the eurozone:

CBDC should be available to all citizens, and its distribution and administration should be carried out through the banking system along the same lines as the current supply of cash. Furthermore, CBDC should be programmable and, at least initially, should not bear interest.

Apart from opportunities, CBDC involves also risks that are pointed out in Box 4.2.

Disintermediation in the banking sector

Deposits could be withdrawn from banks if people decided to hold CBDC on a large scale. Banks would have to refinance themselves in the capital market or raise interest rates on deposits to retain customers.

Bank run:

One the most discussed risks of CBDC, however, is possible changes in behaviour during periods of stress, specifically the risk of a bank run. CBDC will not fundamentally change the situation for banks in a crisis. It does, however, offer an additional channel through which money can be withdrawn from a bank. Deposits could be converted into deposits at the central bank, which up to now has only been an option for banks. This is not a problematic scenario as long as only one individual bank has got into difficulties. But if there was a loss of confidence in the entire banking sector, a new situation would arise since the banking sector as a whole would have to borrow more from the central bank in order to deal with the outflows.

Central bank balance sheet and lending

If demand for CBDC was high, the central bank’s balance sheet could expand significantly. In addition, the central bank might need to provide liquidity to banks experiencing a large, rapid outflow of funds. As a result, central banks would take on credit risk and would have to decide how to distribute its funds among banks, opening the door to political influence.

International implications

CBDCs of reserve currency countries that were available across borders could increase currency substitution (“dollarization”) in countries with high inflation and volatile exchange rates.

Costs and risks for the central bank

Depending on the design of the CBDC, offering CBDC could be very costly for central banks and pose risks to their reputation. Offering a fully-fledged CBDC would require the involvement of central banks in several stages of the payment system value chain, possibly including interfacing with customers, establishing front-end wallets, selecting and maintaining technology, monitoring transactions and responsibility for combating money laundering and terrorist financing. Failure to perform one of these functions due to technological disruption, cyberattacks or simply human error could undermine the reputation of the central bank.

The private banks therefore take the view that CBDC should be created in a two-step process in which the central bank first creates the CBDC and commercial banks then acquire it in the familiar form of central bank allocation. The arguments against a direct form of CBDC are summarised in box 4.3.

Irrespective of this basic position, many issues of importance for the functioning of CBDC need to be clarified by central banks and supervisors (see box 4.2). As a result, the introduction of a programmable central bank digital euro is only likely to be realistic in the medium term.

4.1. CBDC in the view of the private banks

Even under this approach, changes for the banking sector could naturally not be avoided. This becomes clear if we imagine a combination of CBDC and cash as a single form of central bank money available to the end customer. The introduction of CBDC would lead to an increase in the amount of cash in circulation in the economy and to a proportionate reduction in the deposits of non-banks at banks. Banks would thus have to make available a larger amount of their securities or liquidity for “cash”. How large this amount could be without affecting the rest of banking business is a question that cannot be answered at present. This also goes for the question of how to manage the volume of CBDC (see box 4.4).

Should we want to minimise this risk, a form of CBDC would have to be selected where banks would only be intermediaries, i.e. would no longer have to use their own central bank money. But this would mean that privileged access to central bank money would be closed to banks and at the same time opened up to payment intermediaries. The damage this would cause banks would probably be many times more severe than the expected changes in their balance sheet structure outlined in the preceding paragraph.

Towards a sovereign money system

A direct distribution of CBDC by the central bank to end customers could fundamentally change the financial system. This option would pose the greatest risk of ending up in a sovereign money system. In this system, all payment transactions would be made in CBDC. Money creation through lending could no longer take place, which would simultaneously restrict an important function of the banking sector, namely the creation of liquidity and thus maturity transformation. Such a change to the monetary order would also profoundly transform the way capital is allocated in the economy.

Excessive burden on central banks

At the same time, the central bank would have to take on extensive new tasks that have been carried out by commercial banks until now. These include establishing the identity of customers, for example. In complying with anti-money laundering and anti-terrorism legislation, banks have acquired extensive expertise in this area – expertise which a central bank would be unlikely to have, at least initially. Should CBDC be held in account form, the central bank would also have to maintain millions of accounts and handle payment transactions itself.

Lack of assets prevent a direct form of CBDC

The biggest obstacle, however, is the task of creating digital central bank money directly. In today’s monetary system, central bank money is only created in exchange for, or against the lending of, safe securities, usually government bonds. Households do not generally have such securities, however. In principle, there are only two solutions:

- A simple solution would be to issue helicopter money, meaning that households would receive CBDC free of charge and the central bank would in return include a government bond issued especially for this purpose in its balance sheet.

- Alternatively, households would first have to acquire securities eligible for central bank operations from their local bank, for example, and then exchange these for CBDC. This option would be very cumbersome, however, and doubtless be at odds with the image of digital money as being easy and convenient to use.

In a two-step procedure for handling CBDC, too, the impact on the economy as a whole and on the banking sector will depend on the precise details of the design. To maintain the necessary continuity of the monetary order and to keep changes to an absolute minimum, in-depth studies and subsequent decisions will be required. The points that need to be considered include the following:

Convertibility of the various forms of central bank money

If CBDC is to be an equally ranking form of central bank money, convertibility between the three forms of central bank money must be possible in order to ensure the continuity of the monetary system.

Convertibility between CBDC and bank money

Unlimited convertibility into CBDC could quickly put an extreme strain on banks. But if convertibility were restricted, and in the event that banknotes were no longer available, this would mean banks could no longer unconditionally promise to convert demand deposits into central bank money. This would also violate the existing monetary order.

Central bank management of CBDC

To manage the monetary base – cash plus banks’ deposits at the central bank – the central bank has two instruments at its disposal: minimum reserves and interest on central bank deposits. Both options are basically also available to manage CBDC. The role of CBDC between cash – there is no interest on cash – and central bank deposits has not yet been definitively determined, however. And in fact there are arguments both for and against management with the help of an interest rate on CBDC.

-Management through interest ratesThe possible use of CBDC for monetary policy purposes is an argument in favour of an interest rate on CBDC. Application of a negative interest rate could not only allow the interest rate to fall below the zero lower bound but would also reduce the risk of a bank run.

- Management through quantitative restrictions An alternative to management through interest rates would be a possible quantitative limit on CBDC. It may prove difficult, however, to set a threshold that would reconcile the needs of users with the negative impact on the banking system. CBDC, which would not be a liquid form of money, would make little economic sense.

- Instead of an absolute quantitative limit, “tiering” could be considered, possibly in the form of a two-tier interest rate. This option is proposed in an ECB working paper[4] . But this approach, too, leaves key issues unresolved, such as the level of the cap on individual holdings and the question of possible differentiation between households and firms and, if so, on the basis of what criteria.

4.2. Impact on banks

A certain degree of disintermediation will be virtually unavoidable after the introduction of CBDC. But the overall impact on the German banking sector, especially the likely changes to banking and banks’ earnings, can at best be only roughly estimated as things stand since too many unknown variables have to be considered.

What is almost certain is that CBDC will, metaphorically speaking, increase the proportion of cash in circulation. The share of “historic” cash is likely to decrease and with it withdrawals from ATMs, as well as, in parallel, the volume of credit transfers and the use of credit cards and the German payment card girocard. Banks’ corporate clients, at least, are likely to have an interest in a form of money that offers greater security than bank money.

Unless banks take countermeasures, deposit accounts at banks will consequently shrink. To what extent this happens will depend on how attractive CBDC is compared to bank money and other forms of payment, on whether there will be restrictions on exchanging scriptural money for CBDC and on what countermeasures are taken by banks. We describe below three examples of areas where CBDC will exert pressure for change and where banks and economic policymakers will be forced to respond.

1. Impact on the balance sheet

The introduction of CBDC will lead to a contraction of the balance sheet both in the banking system as a whole and at each individual bank since there will be an outflow of deposits and the bank will have to reduce its own holdings of central bank money or securities in return. The exact way in which, and the extent to which, the structure of the asset and liability sides actually change is, however, likely to vary considerably from bank to bank.

To restore their resilience, banks will seek to adjust their liquidity and refinancing positions. For the banking system as a whole, this can only be achieved by expanding the issuance of long-term bank bonds. It is largely unclear from today’s perspective what influence this change in the refinancing structure will have on refinancing costs.

2. Impact on refinancing and earnings

The overall impact of CBDC on the banks’ refinancing situation will essentially depend on the relative attractiveness of CBDC compared to bank money and the relative costs of various refinancing options. Neither relationship is predetermined.

As far as attractiveness is concerned, one influencing factor is likely to be the possibility of earning interest on CBDC. Interest would be a good way of managing the influence on banks’ balance sheets and refinancing. A negative interest rate on CBDC would make it less attractive and thus help to keep deposits with banks. But if CBDC is to be an instrument for making digital transformation more efficient, such a measure would impede the innovation process.

From today’s perspective, refinancing through bank bonds would be more expensive than through deposits, so profitability would decline. It is nevertheless difficult to estimate how the relative cost of various forms of refinancing would develop after the introduction of CBDC, including as a result of the banks’ response.

To assess the influence of CBDC on banks’ earnings, assumptions would have to be made both about the relative costs of the various refinancing options and about the development of revenue streams. It is not possible to extrapolate the current situation to a world with CBDC – in terms, for instance, of the relative cost of different forms of refinancing – since CBDC will lead to a change in the relative prices between, for example, deposits and bank bonds.

The impact on banks will naturally also depend on their response. They will doubtless not stand idly by and watch the outflow of deposits but will try to improve the attractiveness of these compared to CBDC. In what form and to what extent this happens will depend in turn on the costs relative to other forms of refinancing and naturally also on whether banks are able to develop additional services associated with the new form of money and offer them to their customers. It will therefore be crucial to maintain the attractiveness to customers of banks as a contact point for financial services even in a world with CBDC.

And even if refinancing actually does become more expensive for banks, this will not in itself determine whether the increase in costs is ultimately borne by the bank or – in the form of higher charges or higher lending rates, for instance – by its customers. This will depend primarily on the market environment and competitive situation. It is therefore quite conceivable, for example, that the consolidation process in the German banking industry could be further accelerated by CBDC.

3. Responsibility of monetary policy

If, however, the introduction of CBDC ultimately turned out to place an additional burden on either banks or borrowers, the macroeconomic impact would be comparable to that of a rise in the central bank’s interest rate. The introduction of CBDC would thus be tantamount to a contractionary monetary policy measure and would consequently slow down economic growth. This raises the question, which is difficult to answer from today’s perspective, as to the effects of CBDC on monetary policy. Would the central bank have to loosen its policy to compensate for the above effect and, if so, how significant would this correction need to be?

5. Conclusion

The introduction of a programmable euro is indispensable. It will, first, address the needs of users – especially industry – in the context of digital transformation and open the way for the widespread integration of DLT into value-added processes. Second, it is an urgently needed response to the threat to Europe’s digital sovereignty posed by initiatives such as the digital renminbi or Libra. Europe’s competitiveness is at stake as never before.

The provision of a modern, efficient and secure payments system is one of the basic tasks of the banking industry. The private banking industry has recognised the need for a programmable euro but faces considerable challenges when it comes to its implementation. Yet the necessary cooperation within the industry and between the three “pillars” of the German banking system (private, savings and cooperative banks) is hampered not only by competition between banks but also to a large extent by competition policy, which tends to systematically underestimate the role of digitalisation when defining the relevant market. The market power of a US BigTech is too great to be challenged by a single supplier. We therefore call on policymakers to provide coordinating support for the creation of a European standard for a private-sector programmable euro.

A European currency area that can be competitive in the long term without doubt also requires CBDC in the form of a programmable euro issued by the ECB. The private banks believe that, not least in the interests of supporting the aspects mentioned above, the following four points should be taken into account.

- Digital central bank money should be made available in the same way as conventional central bank money, i.e. by the central bank lending to commercial banks.

- Digital central bank money will cause banks’ balance sheets to contract and change their structure. How these changes will influence banks’ lending capacity is an open question at present. CBDC must not be allowed to impair the flexibility of lending over the course of the business cycle.

- The effects on banks’ refinancing costs and earnings are impossible to predict as things stand. Should these deteriorate, banks ability to act and react should not be impaired by regulatory obstacles.

- CBDC should not be used as a monetary policy instrument. First, the prerequisites for this, such as a cashless society, are not met in the euro area. And second, an interest rate deep in negative territory could undermine the reputation of monetary policymakers.

No time should be lost in meeting the challenges outlined above. For this reason, rapid political intervention is required. The introduction of a programmable euro cannot be the task of the banking industry or the ECB alone. A process must be defined for introducing a programmable euro without delay. At European level, responsibility will lie with the European Commission. At national level, it will be up to the Federal Chancellery to act as a coordinating body to ensure a cross-industry perspective. The initial objectives in the coming months should be

- cross-industry identification of the need for a programmable euro and large-scale sensitisation of businesses to the issue;

- the development of a European strategy for a programmable euro; and

- the definition of a roadmap with the involvement of all stakeholders.

[1] Financial Stability Board (FSB): stablecoins are crypto-assets or, in a broader sense, digital assets. Stablecoins have a fixed value in relation to a specific individual asset or basket of assets.

[2] The FSB is working on a central proposal in the context of the G20 (https://www.fsb.org/wp-content/uploads/P090420-1.pdf).

[3] There are basically two alternatives, a hybrid or fiduciary model and the indirect model, which we favour. In the hybrid or fiduciary model, as in the indirect model, the end customer has no direct access to central bank money but uses an intermediary to act between the end customer and the central bank. Unlike in the indirect model, however, the intermediary only performs an administrative function when executing transactions. End customers acquire a direct claim to payment vis-à-vis the central bank, which they can call in through their fiduciary intermediary.

[4] https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2351~c8c18bbd60.en.pdf